Giving a talk at the Nepean-Hawkesbury VIEW Club on 17 June 2024.

A site on retirement, life changes and planning for your future.

Giving a talk at the Nepean-Hawkesbury VIEW Club on 17 June 2024.

The Australian Institute of Family Studies (AIFS) has released its research into the rate of Australian divorces. While the rate of divorces for all age groups has remained constant, if not, actually decreasing slightly, the rate of divorce for older couples (over 65 years) and long-term marriages (over 20 years) is steadily increasing.

Divorces

The crude divorce rate (divorces per 1,000 Australian residents) was 2.2 divorces per 1,000 residents in 2021, up from 1.9 in 2020. The total number of divorces granted in 2021 was 56,244, the highest number of divorces recorded since 1976. However, this high number (and therefore also the crude divorce rate) was affected by administrative changes that have enabled divorces to be finalised in a reduced time frame. For this reason, the Australian Bureau of Statistics (ABS) cautions about comparing the 2021 divorce statistics to those of earlier years.1

Since the 1990s the crude divorce rate has trended downward, reaching a low of 1.9 per 1,000 residents in 2016, 2019 and 2020. The higher 2021 figure disrupts the trend over recent years, although, as noted above, the break in series may be due to changes in administrative arrangements.

After very low rates in the first half of the twentieth century, the crude divorce rate rose in the 1960s and 1970s. It peaked at 4.6 per 1,000 resident population after the introduction of the Family Law Act 1975 (Cth), which came into operation in January 1976 and allowed no-fault divorce. As some long-term separations were formalised and some divorces that had been filed in the previous years were brought forward, this contributed to the steep rise in the number of divorces in 1976.

Between 1986 and 1996, age-specific divorce rates increased across all age groups for both men and women.

From 1996 to 2016, while the divorce rate overall declined, the trends in divorce rates differed between younger and older age groups: falling for men under 45 years and women under 40 years increasing for men aged 50 years and older and women aged 45 years and older.

Between 2016 and 2021, the age-specific divorce rate increased for all age groups of men and women but, as noted above, this may simply indicate that the administrative changes affected the processing of divorces across all age groups.

The trends in divorce discussed above apply only to married couples and do not capture the extent to which people in cohabiting relationships separate over time. Research indicates that cohabiting relationships are more likely than marriages to end in separation, particularly when cohabitating couples have not otherwise gone on to marry (Hewitt & Baxter, 2015; Qu, Weston, & de Vaus, 2009).

At what age are couples divorcing?

The median age of men and women rose between the early 1980s and recent years, which is largely attributed to trends in people marrying later as well as more divorces involving longer marriages (see the discussion on marriage duration below).

The upward trend in the median age of divorce has stalled since 2018. In 2021 the median age at divorce was 45.9 for males and 43.0 for females, similar to the median ages in 2018 and 2019 (45.9 for males and 43.1 for females for both the years).

Median age at divorce in 2021 – Overall, the median age at divorce has been rising since the 1980s; 43.0 years for females and 45.9 years for males.

Duration of marriage to divorce

The largest proportion of couples separating and then divorcing were married for nine years or less. In 2021, 56% of separations and 41% of divorces were couples in this category. This showed little change from 2020.

Couples who had been married for 20 or more years made up more than one-quarter of divorces in 2021. In the 1980s and 1990s these couples made up a smaller proportion, at around one in five divorces.

The median duration of marriage to divorce for divorcing couples over the last decade (2011–21) was between 12 and 12.2 years, and the median duration of marriage to final separation was 8.3 to 8.7 years. In other words, it took 3–4 years from separation for divorcing couples to finalise their divorce.

What about the children?

The proportion of divorces involving children under 18 years has fallen since the 1970s, from 68% in 1975 to 47% in 2014. It has remained at around this percentage in recent years, shifting slightly higher, to 48%, in 2021. The general declining trend is partly due to the rise in divorces of long-term marriages where children are already grown up. An overall decline in the fertility rate and a rise in childlessness may also contribute to the fall in the proportion of divorces involving children.

It is also important to note that divorce statistics do not include separations of cohabiting couples with or without children. Research suggests that cohabiting couples with children were more likely than married couples with children to separate (Qu & Weston, 2012).

Divorces of same-sex marriages

Same-sex marriages were included in the marriages data for the first time in 2018, following the Amendments to the Marriage Act 1961 that allowed same-sex couples to legally marry in Australia and came into effect on 9 December 2017. Divorces of same-sex couples were recorded for the first time in 2021.

There were 473 divorces granted for same-sex couples, representing 2.5% of all same-sex marriages registered between 2018 and 2021.

There were 306 divorces of female same-sex couples and 167 divorces of male same-sex couples between 2018 and 2021, representing 2.9% of female same-sex marriages and 2.3% of male same-sex marriages registered in that period.

To read the entire article, go to: https://aifs.gov.au/research/facts-and-figures/divorces-australia-2023.

References

Australian Bureau of Statistics (ABS). (various years). Divorces Australia (Catalogue No. 3307.0, 3307.0.55.001). Canberra: ABS.

Australian Bureau of Statistics. (various years). Marriages and Divorces Australia. Canberra: ABS.

Australian Bureau of Statistics. (1980). Social Indicators 1980 (Catalogue No. 4101.0). Canberra: ABS.

Hewitt, B., & Baxter, J. (2015). Relationship dissolution. In G. Heard & D. Arunachalam (Eds.), Family formation in 21st Century Australia. Dordrecht: Springer.

Qu, L., & Weston, R. (2012). Parental social marital status and children’s wellbeing. (Occasional Paper No. 46). Canberra: Department of Social Services.

Qu, L., Weston, R., & de Vaus, D. (2009). Cohabitation and beyond: The contribution of each partner’s relationship satisfaction and fertility aspirations to pathways of cohabiting couples. Journal of Comparative Family Studies, 40(4), 585–601.

1 ABS (2021) stated: ‘The Federal Circuit and Family Court of Australia have advised that the high number of divorces finalised in 2021 is in part related to administrative changes to increase finalisations and reduce time frames. These changes enabled the finalisation of more applications for divorce than previous years and allowed the court to reduce backlogs by finalising more divorce applications in the year than were received. This constitutes a break in time series and any comparison with earlier years should be made with caution.’

Scanlan Carroll Lawyers, Carol Pagès

If you have recently separated, your focus will likely be on what to do about the property you have with your ex partner, and arrangements for your children.

So why do you need to think about your Will?

If you have a Will, it may be that each of you and your ex partner have left everything to each other, and then to your children.

If you are separated, it is important to take the time to review all of your estate planning documents – this includes your Will, your Powers of Attorney, and your Binding Death Benefit Nomination of your superannuation fund.

Each of these documents is explained below:

Your Will – your Will sets out how you would like your assets distributed when you die and who is responsible for carrying out your wishes. You can also include clauses such as your nominated guardian for children under 18, and specific gifts that you would like to make. In your Will you specify who will be your executor. Your executor stands in your shoes when you die, and they will carry out your wishes by calling in your assets and distributing same to your chosen beneficiaries.

Enduring Power of Attorney – While you are alive, your attorney is able to stand in your shoes and carry out financial transactions on your behalf using the power – this can be buying or selling property on your behalf if you are away on holidays, transacting on your bank account paying your bills for you, and so on. Your nominated attorney can also make personal care decisions for you – such as choosing a care facility if you are unable to look after yourself, or limiting or restricting a person from visiting you if they consider this is not in your interests.

A separate medical decision maker (which can be the same person) will be able to make medical decisions on your behalf, such as consenting to surgery if you are unable to. As the powers are enduring, they continue even if you later suffer an illness or injury which means you are unable to make decisions for yourself.

Binding Death Benefit Nomination (BDBN) – many people have significant balances in superannuation and also life insurance policies attached to their funds. As part of your estate planning process, we provide you with advice about your BDBN as superannuation is generally considered to be ‘outside’ of your estate and what is covered by your Will. It is important that this valuable asset is passed on to your loved ones in the way that you intended.

Why is this important?

Separation does not trigger the end of your existing Will, Powers of Attorney or BDBN. Many people are surprised to learn that divorce does not invalidate your Will. Divorce revokes a gift to your former spouse or appointment as your executor, and remarriage can invalidate your Will save for references made to your current spouse.

What if I don’t have a Will?

If you don’t have a Will, your assets will be passed on to your relatives according to the rules of intestacy. The rules in Victoria are that if you die, your estate goes to:

Your spouse or domestic partner if you have no children;

Your spouse or domestic partner, if you have children with that partner;

If you have children to a previous relationship, your spouse will receive a statutory legacy (currently $480,700), your personal possessions, and 50% of the balance of your estate. Your children will equally share the remaining 50% of your estate.

Case study – who inherits?

Alex separated from Danielle three years ago. They were married however had no children. They were able to resolve their family law property division fairly amicably, and finalized their family law case with Consent Orders dividing their property.

Alex and Danielle prepared their Wills when they were first married 10 years ago, each leaving their estate to the other.

Alex has re-partnered with Mary, and they have been together for 20 months.

Alex and Danielle haven’t yet filed for divorce as they have not gotten around to it yet. Alex has the forms on the kitchen table to sign.

Alex tragically dies before signing his divorce form.

Who do Alex’s assets go to………..?

Depending on a number of factors – it’s Danielle – his former wife.

The gifts to Danielle in Alex’s Will are not revoked as they are not divorced.

If Alex owned property such as a house with Mary, and the house was in joint names – the house would be outside of Alex’s estate and pass straight to Mary.

What if Alex didn’t have a Will?

Based on the length of the relationship with Mary (along with several other factors which would need to be taken into account under the Family Law Act 1975 (Cth)), Mary is not likely to be considered a spouse.

Danielle is still Alex’s legal spouse, as they are not divorced, so Danielle receives Alex’s estate.

Summary

Mary may have grounds to make a claim in either scenario, but this can be a long and expensive legal process which no one wants to go through after the loss of a loved one.

The above example shows that how an asset passes on after death can depend on a number of factors. To ensure that your wishes are as you intended, it is important to obtain advice in relation to your family law and estate planning matters.

This is important at separation, and the time following separation – for example, when you re-partner, it is worth considering the impact of your new relationship and property ownership upon your children, and your new partner.

Why is retirement different for women? Women retire with about 60% of the superannuation funds that men have. They live 5 years longer and they are far more reliant on the aged pension. On the plus side – women are more likely to retain their friendship networks, more likely to be the principal carer for their partner, their parents and their grandchildren, as well being more likely to volunteer to help others.

Listen to my wide-ranging discussion with community radio 2RDJ broadcaster, Neil Lithgow about women and retirement. Listen here:

By simply spending 30 minutes of your time answering these questions about yourself, you can make a contribution to research about ageing and Australian women.

What is AgeHAPPY?

The Healthy Ageing Project Population Youth-senior (AgeHAPPY) is an online heath survey for Australians. The Healthy Ageing Project (HAP) mission is to improve the understanding of health across a lifespan to promote healthy ageing and prevent disease.

This round of the survey commenced in 2020. It started with a pilot study called HAP. Data on self-reported health, lifestyle, mood, and vascular risk factors is being collected from male and female participants aged 18 years and over. AgeHAPPY is a continuation of the Women’s Healthy Ageing Project (WHAP).

WHAP commenced in 1990 as a study examining the health of Australian women from midlife (then aged 45-55 years) before the menopausal transition and into ageing. The study has almost 30 years of data on mood, dietary intake, risky behaviours, physical activity and social connectedness among other factors. WHAP continues to follow up these women, who are now all aged over 70 years. The children of the original participants have now joined the study as of 2021 commencing the WHAP generations study.

AgeHAPPY is a study into the lifelong effects of lifestyle and habits on health and the progression of ageing. Everyone over 18 years of age can participate in the online health questionnaire. This research ultimately contributes to promoting healthy ageing in Australia and to improve the wellbeing of all Australians.

Chronic disease is the largest cause of death and disability in Australian society and throughout the western world. The information collected will enable greater understanding of the impact of social and behavioural factors on health and influence policies toward better prevention and early detection of health issues, including Parkinson’s and Alzheimer’s disease.

Most studies on “ageing” are usually limited to the elderly. HAP defines ageing as a phenomenon that occurs continuously throughout all stages of life – and presents its health challenges at all ages. Many studies show that indicators for chronic disease occur years before onset.

Through this online health survey, HAP can collect valuable demographic, clinical, behavioural and lifestyle data which allows them to analyse the impact of factors on health and ageing at every age.

Get involved in the AgeHAPPY study

The first section of the study is an online questionnaire covering areas such as demographic information, general health history, family health history, mood, quality of life, physical activity, sleep, diet, alcohol intake, smoking, physical function, social relationships, and negative life events.

The second section is a cognitive component which tests thinking skills, a bit like a brain game. A participant will be invited to complete the online cognitive testing from the Healthy Brain Initiative – Brain Health Registry (HBI-BHR). The Brain Health Registry is a web-based study that enables researchers to efficiently identify, assess and monitor the brain changes associated with the progression of neurodegenerative diseases and brain ageing more efficiently.

In 12 months’ time, HAP will contact you to complete a follow-up online questionnaire.

To participate, please follow the link:

https://medicine.unimelb.edu.au/research-groups/medicine-and-radiology-research/royal-melbourne-hospital/healthy-ageing-program/healthy-ageing-project

Grandparents reported feeling disconnected and isolated from their children and grandchildren during the COVID restrictions imposed during 2020.

In two surveys conducted by the Australian Institute of Family Studies during each half of 2020, three out of 10 grandparents said that prior to the COVID-19 outbreak, they provided childcare to their grandchildren at least weekly. Of those grandparents, 14% of respondents with grandchildren aged under 13 years provided child care daily or several times a week, another 16% provided child care about once a week and around half provided care at least once per month.

Grandparent care and care for grandparents were most impacted during the pandemic, with respondents reporting that for many families, grandparents did not provide the usual care to their grandchildren for some months during the pandemic. Care for grandchildren ceased because of restrictions imposed on visiting family members or because parents increased their work from home.

Many grandparents reported feeling disconnected from their family and missing out on family traditions during the lockdown period. While some grandparents were able to access technological solutions to connect with family, others found the technology frustrating.

There were 7,306 respondents in the first survey of whom 6,435 completed all survey questions. In the second survey, 4,866 participants responded, of which 3,627 completed all survey questions. Over 80% were female respondents, tertiary-educated, ranging in age from over 18 years to 60+ years who lived either in a capital city, a major regional city or regional area.

Impacts on caring for others

In addition to generalised fears as to how the virus might affect the physical and mental health of family members, the pandemic forced changes to the availability of in-home support services. Caring hours for family members increased significantly over the year for 70% of respondents, nearly half of the respondents saying they spent over 30 hours per week in relation to child care and home schooling, while about 20% of respondents reported spending over 60 hours per week on caring activities which included caring for a parent or a partner.

Respondents also referred to giving assistance to non-household members which could include friends or work colleagues. This could include giving emotional assistance, or providing help with shopping, transport, house or garden maintenance and sometimes financial help.

Community volunteering was also impacted by the pandemic during 2020 in that in many volunteer-reliant charities, older volunteers were restricted in the types of volunteer work they could do and, at the same time, demand for services from charities increased due to the impact of COVID on employment and income.

Community volunteers were more likely to be older people. Survey results showed that over a quarter (27%) of respondents or their partners had engaged in some form of voluntary work in the past year, including half of those aged 70-79, 36% of those living alone, and 40% of those living in remote areas.

Of those who volunteered at some time during 2020, almost two in three (62%) continued to volunteer throughout the year, 20% volunteered before COVID but had yet to return to volunteering, 6% started volunteering after COVID, 4% stopped volunteering during COVID but have returned to volunteering, and 4% volunteered only during COVID. (The remaining 5% is other combinations.)

Report no. 1: Connection to family, friends and community, Families in Australia Survey, May 2021, https://aifs.gov.au/publications/connection-family-friends-community

104cm x104cm (framed with Perspex)

Leanne Vincent, 2020.

Each sea blue petal, gathered

in honour of Detritus, was slow

stitch’d into this teeming quilt,

this bowerbird mandala,

this cathedral rose window

in the navy night,

this rock pool in kaleidoscope.

And now the Seaweeds, from

Photographs of British Algae

to whom Flourish is indebted,

wave from their 19th century pages

in a lineage of ecologies.

Come along to join in the retirement conversation on

At the Dennis Johnson Library, Cnr Stanhope Parkway & Sentry Drive, Stanhope Gardens, NSW 2768

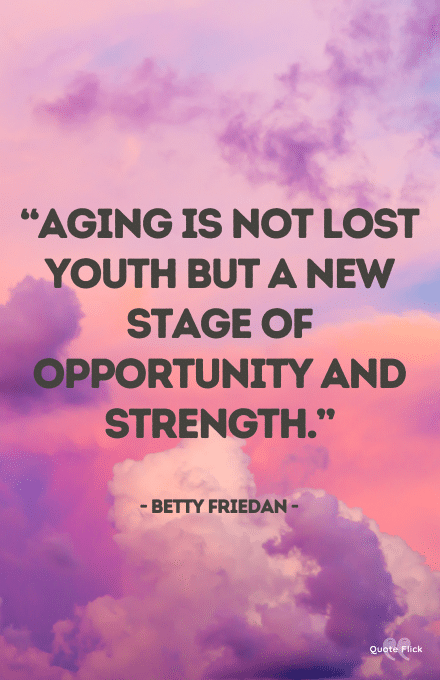

Women experience retirement differently to men. Women generally live longer, have less money and volunteer more than their male counterparts. A practicing lawyer for over 30 years, Alice Mantel encourages making better decisions, giving advice on topics such as:

Inspiring women to make the most of their retirement opportunities, Every Woman’s Guide to Retirement encourages an active, connected lifestyle, staying healthy, lifelong learning, de-cluttering, and even online dating to make the most of this time.